News and updates

Current BCF Wessex articles for our Gensen software, budget and legislation comments, Fleet Tax Guide updates and software breakthroughs.

Jeff Whitcombe of BCF Wessex decodes the Rachel Reeves Budget which has implications for employers and raised NIC, but provides continued support for electric vehicles and salary sacrifice.

With the government’s commitment to support the take-up of electric vehicles (“EVs”) by maintaining competitively low BiK tax rates from 2028 to 2030, the Chancellor has provided the clarity and certainty required by company car and salary sacrifice providers.

All Gensen salary sacrifice clients will have access to the latest documentation and software updates upon launch of the new scheme partnership for AVIVA, via Lloyd Latchford, in October 2024. Employers and employees will be able to take advantage of the new pricing and policies from 1st October.

With 2023 beginning to fade already, we’d like to consider what’s changing in the automotive industry, how these changes might play out in 2024 and how BCF Wessex and our Gensen platform can meet these new challenges.

Less than a week ago political commentators and pundits were predicting that inheritance tax would be cut in the Autumn Statement delivered by Chancellor, Jeremy Hunt, on 22 November 2023; perhaps with some movement on corporation tax to boost investment, but that was it.

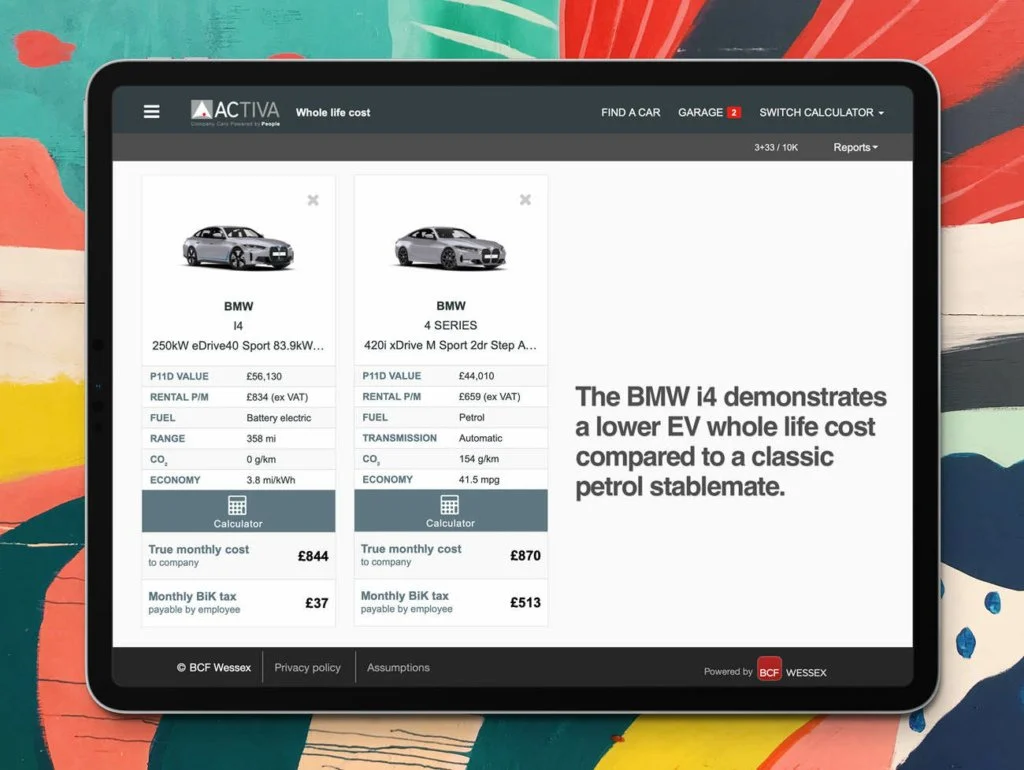

Whole life cost calculations will be affected by both the higher inflation and the increased interest rates.

A year ago, you would have expected electric vehicles (EVs) to be considerably cheaper than petrol and diesel (ICE) cars when considering their respective whole life costs…

Gofor is introducing a driver portal for its expanding client base of salary sacrifice customers. The new portal is an extension of the Edinburgh-based leasing broker’s arrangement with salary sacrifice consultancy BCF Wessex.